Tax Amnesty 2021 Can Be Fun For Anyone

Wiki Article

The smart Trick of Tax As Distinguished From License Fee That Nobody is Discussing

Table of ContentsThe Ultimate Guide To Tax4 Easy Facts About Tax As Distinguished From License Fee ShownUnknown Facts About TaxonomyThe Buzz on Tax AccountingTax Avoidance Can Be Fun For EveryoneThe 8-Minute Rule for Tax AvoidanceAll about Tax As Distinguished From License Fee

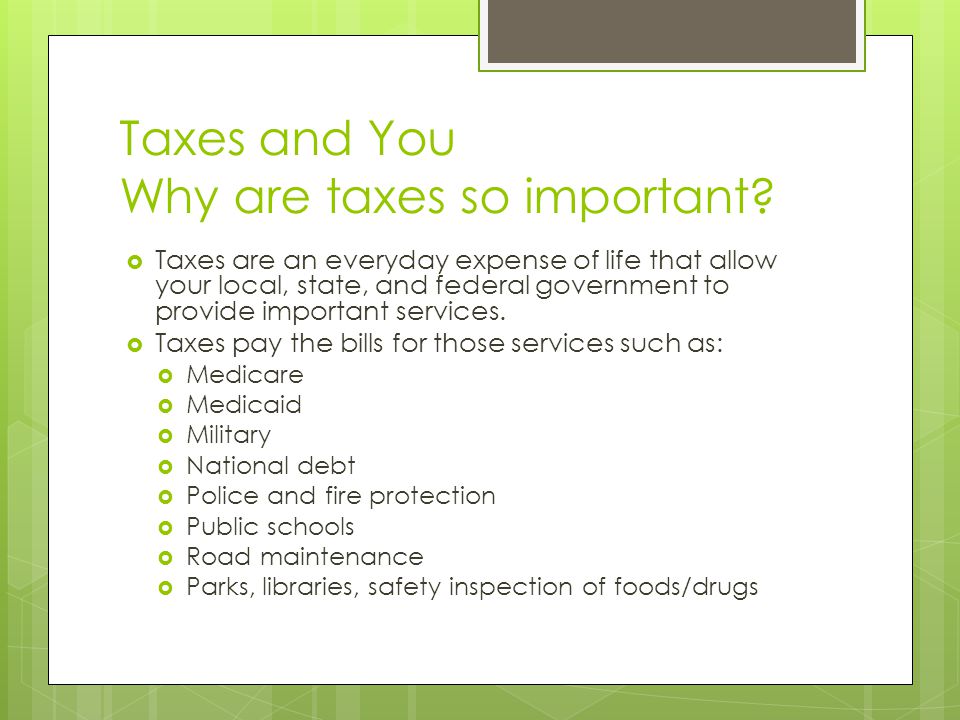

More Analysis, For much more on revenue tax, see this Northwestern Legislation Institution article and also this College of Chicago Law Testimonial write-up.To meet their expenditures, government need earnings, called "income," which it elevates with taxes. In our country, governments levy a number of various types of tax obligations on individuals and organizations.

The 2-Minute Rule for Tax Amnesty

Some services are much more efficiently provided when federal government firms prepare and administer them. Every person advantages from these services, and also the most sensible method to pay for them is through tax obligations, instead of a system of solution fees.There are also laws to manage such points as the usage of signboards as well as indications along freeways. The complimentary business system is based on competition amongst businesses.

To ensure that a degree of competitors exists, the Federal Government implements strict "antitrust" regulations to avoid any person from getting syndicate control over a market. Some services, referred to as "natural syndicates," are more effectively provided when there is competitors - tax avoidance. The best-known examples are the energy companies, which supply water, natural gas, as well as electricity for home as well as organization use.

Rumored Buzz on Tax Accounting

The capitalism system presumes that customers are educated regarding the quality or safety and security of what they buy. Nonetheless, in our modern society, it is commonly impossible for customers to make educated choices. For public defense, government firms at the Federal, State, and neighborhood levels problem and also impose guidelines. There are policies to cover the high quality and also safety of such points as house construction, cars and trucks, and electric devices.

An additional important form of consumer security is the usage of licenses to prevent unqualified people from working in specific areas, such as medicine or the building professions. City and county governments have the main obligation for primary and secondary education.

Federal grants utilized for conducting research are a crucial source of money for schools. Given that the 1930s, the Federal Government has been offering earnings or solutions, commonly called a "safeguard," for those in demand. Significant programs consist of wellness solutions for the senior as well as financial assistance for the impaired and also jobless.

Tax Amnesty for Dummies

Taxes in the United States Governments spend for these solutions through profits obtained by taxing three financial bases: earnings, intake and wide range. The Federal Government tax obligations earnings as its major resource of revenue. State governments utilize tax obligations on revenue and consumption, while local governments rely practically completely on straining property and also wealth.The personal income tax produces regarding five times as much revenue as the business income tax. Not all earnings tax taxed in the same way.

By contrast, the passion they earn on cash in a regular financial savings account gets included with incomes, salaries and also various other "regular" earnings. tax as distinguished from license fee. There are also numerous kinds of tax-exempt and tax-deferred financial savings prepares offered that impact on individuals's tax obligations. Payroll taxes are a crucial resource of income for the Federal Federal government.

Some Of Tax Avoidance Meaning

Staff Look At This members also pay into the social security program via money held back tax amnesty 2021 from their incomes. Some state federal governments likewise make use of pay-roll taxes to pay for the state's unemployment settlement programs. For many years, the amount paid in social safety tax obligations has greatly enhanced. This is due to the fact that there are less employees paying into the system for every retired person now receiving benefits.Taxes on Intake The most important tax obligations on usage are sales and import tax taxes. Sales tax obligations normally get paid on such points as autos, garments and also motion picture tickets. Sales tax obligations are a crucial resource of profits for most states and also some big cities as well as areas. The tax rate differs from one state to another, as well as the list of taxable items or services additionally varies from one state to the following.

Instances of items subject to Federal import tax taxes are heavy tires, angling equipment, plane tickets, fuel, beer and also alcohol, weapons, and also cigarettes. The objective of excise taxes is to put the problem of paying the tax on the customer. A good example of this use excise taxes is the gasoline excise tax.

The 6-Second Trick For Tax Amnesty 2021

Only individuals who purchase fuel-- that utilize the freeways-- pay the tax. Some products obtain strained to YOURURL.com prevent their use.A lot of areas tax obligation personal homes, land, and organization residential property based on the building's value. Typically, the taxes get paid monthly along with the home loan repayment.

Everything about Taxonomy

Likewise, taxpayers might subtract a particular amount on their tax returns for every allowed "exemption." By decreasing one's gross income, these exceptions as well as reductions support the fundamental concept of tiring according to capacity to pay. Those with high taxed earnings pay a bigger portion of their income in taxes. This percentage is the "tax price." Because those with higher taxed revenues pay a higher portion, the Government revenue tax is a "modern" tax obligation.Report this wiki page